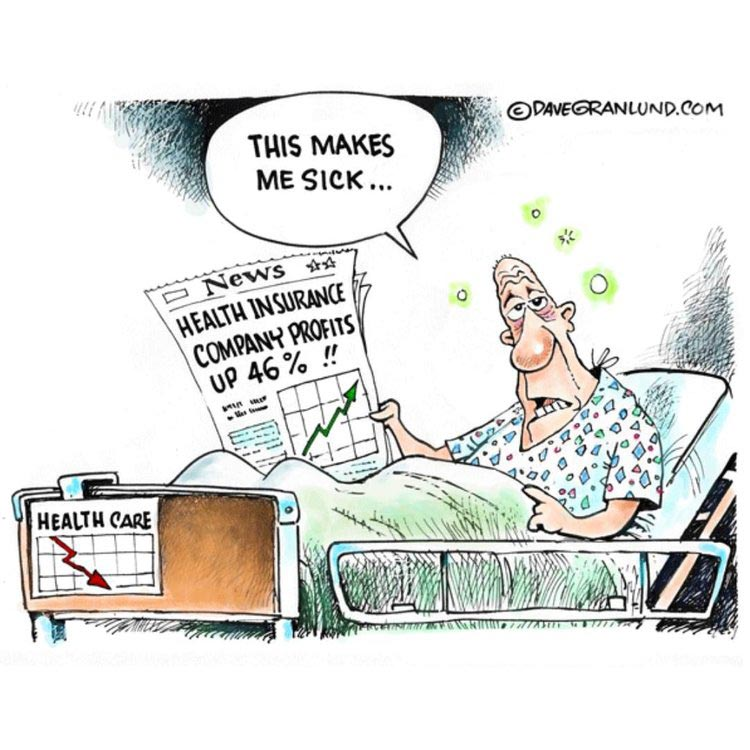

Healthcare in America today is one of the most polarizing topics of discussion one could possibly choose. If you watch any of the presidential debates over the next year and a half, healthcare will be at or near the top of the list of most discussed issues. It is clear that there is no consensus as to what the best model for health care is on a large scale, but it is also clear that the current model is not effective, efficient or sustainable. One of the many reasons why our current model is broken is the role and power of health insurance companies in the care of their subscribers. I want to take this opportunity to give a look “behind the curtain” as to why a payer-driven model is not designed to promote the health and wellness of an individual on any scale. I will also discuss the difficult decisions that this system often forces consumers and providers to make, and what alternatives are available so that the pitfalls of the current system can be mitigated or avoided altogether.

First of all, let’s define what I mean by a payer-driven system. In the context of American health care, this means that a health insurance company has the right to make ultimate and final decisions that have physical, mental, and financial implications for patients and providers. In a payer-driven system, insurance companies have the right to dictate almost everything about your care – what services or providers are covered or not covered, how frequently or how many times you can receive care within a certain time period, what they will pay a provider for a given service or product, and whether a product or service is “medically necessary”. Let’s dive a little deeper into the implications of a health insurance company being the decision-maker when it comes to your health and medical care.

Many insurance companies elect to not cover certain health care services or products at their discretion. Examples include hearing aids and associated exams/fittings, lasik eye surgery, certain hospital admissions/stays, vaccines for international travel, “alternative therapies” (acupuncture, chiropractic, massage), “out of network” providers, and even some preventative testing (PSA for example) (Source: Huffington Post). In addition, some insurance plans have benefit limits for certain services (physical therapy, occupational therapy, speech therapy, mental health, etc.) that either limit the number of times a client can be seen by a certain provider or a certain maximum dollar amount that they will pay for certain services over the coverage period. For example, I have frequently come across insurance companies that have strict limits of as few as 5 visits in a calendar year for physical therapy. So not only do health insurance companies try to dictate who you see for a given service or procedure, but they also try to dictate what that provider does and doesn’t do for you and how often or how many times they can provide that service for you. Providers have to make a living for themselves, so finances often come into play when deciding what services to provide or recommend. If a provider knows insurance won’t cover a given service, then the provider is left with a choice between two bad options – either not getting paid for their services, or choosing to only provide services that are covered by insurance, even if those services aren’t the best option for the patient. Health care professionals complete many years of training to gain the expertise required to be licensed in their field and be independent decision-makers acting in the best interest of a patient – shouldn’t they work in an environment where they are the ones that decide what treatments are best for a patient rather than an insurance adjuster who has minimal to no health care training and only has the company’s best interest in mind?

Insurance companies also have a say-so when it comes to cost of services. Insurance companies often enter into agreements with companies, practices, and individual health care providers, and part of those agreements include a negotiated fee schedule. This fee schedule includes a list of covered services and how much the insurance company will pay for these services. For instance, the cash value of a dental cleaning may be $200, but an insurance company may come back with a proposed fee of $100. Now a provider may push back and say, “We can’t be profitable at that price.” The insurance provider can come back and point out that other providers have agreed to this fee schedule, so if a provider doesn’t agree to this price, then he or she simply won’t be able to see individuals who are covered by this insurance company. Now the provider is faced with a choice – refuse to comply with the fee schedule and understand that he or she will likely miss out on being able to treat a large population of potential clients, or comply with the fee schedule and inevitably sacrifice quality in the process. Why does quality have to suffer? If a fee schedule slashes the margins of a provider or a practice, there is only one choice – see more patients. Rather than spending an hour with each client with highly individualized care and attention, a practitioner may have to decide to make appointments only 15 minutes in order to maximize volume at the expense of quality and individualized care and attention. Why should insurance companies force providers to make these kind of decisions? Why should a provider have to choose between providing the highest quality of care and being fairly compensated for their skills and services?

In my mind, the most dangerous power that insurance companies have in our system is the power to determine “medical necessity.” In other words, they can decide to deny payment for a service that they don’t think a patient needs. Sadly, these companies aren’t just denying claims for things like cosmetic surgery or elective procedures that truly aren’t medically necessary. There are numerous documented cases of claims denials in cases of almost undisputed medical necessity, such as is the case from this article from the LA Times in 2018 (Source: LA Times, 2018). The author of the article details how they were diagnosed with Type I Diabetes as a child and had been using an insulin pump for 9 years, but when the time came around to replace the pump, his insurance company denied the claim based on “medical necessity.” How is it not medically necessary for a diabetic patient to have his insulin pump working properly? Well, the author of this article also referenced a study from 2011 that shows that roughly 50% of claims that are denied for medical necessity are covered once appealed. That is a terrifying statistic! In other words, 50% of denials are unjustified and these companies are willing to take the chance that an individual won’t be willing to have the patience or endurance to make it through the appeals process to receive the benefits that they have paid for and deserve. Wouldn’t it be nice if our health insurance was an ally in our quest for optimal health rather than a roadblock and adversary?

If you’ve made it this far, you probably agree at least to some extent that our current system has some undeniable flaws, with both private and government-funded insurance entities ranking very high on the list of those pitfalls. That begs the question – now what? What can we as individuals do about this system? How can we act in the best interest of ourselves and our loved ones? I can think of three primary directives that all Americans should enact in the current healthcare climate. First, consumers need to look into creative savings options to help fill in the gaps in coverage specific to their plan. In addition to health insurance coverage, many employers offer the option to allocate funds to a Health Savings Account or Flex Spending Account, which are both pre-tax accounts which can be used for non-covered services. I personally use my HSA for almost all of my health care expenses – not only does it save me money (less income tax paid), but those funds are not subject to insurance approval or review as to how they are spent. Secondly, we should rely on the recommendations of our personal network and our own independent research over the recommendations of our insurance company when it comes to choosing providers and treatment options. Practitioners who accept insurance are not bad people (I’ve been one!) – they are often very skilled providers who are simply trying to serve a large segment of the population while running a successful business. However, you as the consumer and patient have a choice as to who you want to be treated by – and just because your insurance company doesn’t list a provider as “in-network” doesn’t mean that you can’t get partially or fully reimbursed for his or her services. Finally, consider alternative models of health insurance coverage. If you are like me and you detest the idea of health care insurance executives making millions while providers fight for the crumbs they pay out and subscribers are strapped with the burden of paying for uncovered services while the insurance company continues to collect premiums, there are alternatives. I personally subscribe to a medical cost-sharing ministry in the place of traditional private health insurance, and there are numerous variations of these on the market today (Source: Health Sharing Ministries). These are non-profit organizations that pool like-minded people together to share the burden of each other’s health care costs. My monthly payments are going directly toward another subscriber’s medical bills – not into the pockets of a health insurance executive. These plans aren’t perfect either, but I love the model of shouldering one another’s burdens.

Sorry for the long post, but this is a tough topic to cover succinctly, and I hope you’ve walked away from this with a better understanding of the deficiencies of our current system and what you as an individual consumer can do to mitigate these deficiencies. These issues are some of the primary reasons Limitless Therapy and Wellness exists – to break the chains that health insurance companies try to place on patients and providers and provide the highest level of care possible with no meddling from a third party. I’d be glad to respond to any questions or points of contention at jordan@z56.17c.mytemp.website. Thanks for reading!